Financial liberalization and the financialization of commodity markets

Financial liberalization and the financialization of commodity markets

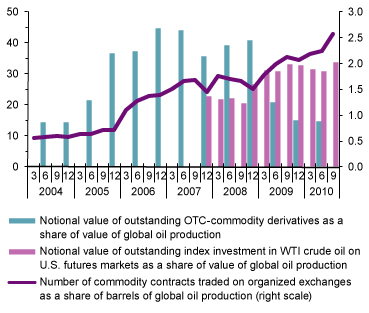

Financial investment in commodities as a proportion of global oil production, 2004-2010

(Percentage)

Source: UNCTAD, TDR 2011 (Chart 5.2), based on BIS, Derivatives Statistics; CFTC, Index Investment Data; Energy Information Administration (EIA), International Petroleum Monthly; and UNCTADstat

Recent developments in primary commodity prices have been exceptional in many ways. The boom between 2002 and mid-2008 was the most pronounced in several decades – in magnitude, duration and breadth. The price collapse following the eruption of the global crisis in mid-2008 stands out both for its sharpness and for the number of commodities Commodities include food products, agricultural raw materials, minerals, ores and metals, and petroleum.

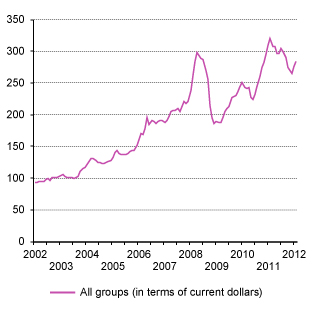

affected. After mid-2009, and especially from mid-2010 onwards, global commodity prices recovered strongly. While the oil price increases up to April 2011 were modest compared with the spike in 2007–2008, food prices reached an all-time high in February 2011. Sizeable corrections occurred in May and August 2011, but since then prices have recovered (Chart) Evolution of monthly commodity price indices,

January 2002-February 2012

(Index numbers, 2000=100)  Source: UNCTAD, UNCTADstat Commodity Price Statistics Note: All groups consist of 1) Food and beverages, 2) Agricultural raw materials, and 3) Mineral, ores and metals (excluding petroleum). . Such wide price fluctuations can have adverse effects for both commodity importing and exporting countries, as well as impact the resilience of households and commodity producers.

Source: UNCTAD, UNCTADstat Commodity Price Statistics Note: All groups consist of 1) Food and beverages, 2) Agricultural raw materials, and 3) Mineral, ores and metals (excluding petroleum). . Such wide price fluctuations can have adverse effects for both commodity importing and exporting countries, as well as impact the resilience of households and commodity producers.

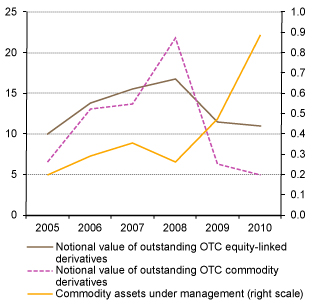

The fundamental factors driving recent commodity price developments include surging demand, especially from rapidly growing developing countries; a relatively sluggish supply response and certain policies encouraging non-food related uses of food commodities. But recent price developments have also coincided with a greater weight on commodity derivatives markets of financial investors that consider commodities as an asset class (Chart) Financial investment in commodities and equities as share of global gross domestic product, 2005-2010

(Percentage)  Source: UNCTAD, TDR 2011 (Chart 5.1), based on BIS, Derivatives Statistics; Barclays Capital, The Commodity Investor; and UNCTADstat . This financialization of commodity markets has accelerated significantly since about 2002–2004.

Source: UNCTAD, TDR 2011 (Chart 5.1), based on BIS, Derivatives Statistics; Barclays Capital, The Commodity Investor; and UNCTADstat . This financialization of commodity markets has accelerated significantly since about 2002–2004.

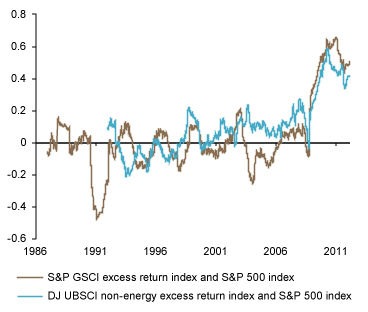

Correlation between commodity and equity indices, 1986–2012

(Coefficient)

Source: UNCTAD secretariat calculations, based on Bloomberg

Note: The data reflect one-year rolling correlations of returns on the respective indices, based on daily data.

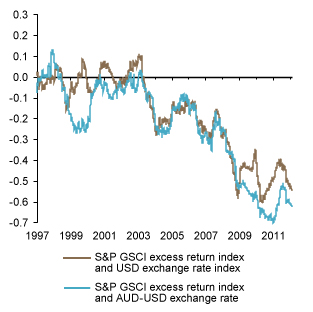

The debate on the price impact of financial investors has pointed to the increasingly close correlation between returns on investment in commodities and equities, as well as those related to the exchange rates of currencies affected by carry trade speculation (Chart) Correlation between financial investment in commodities and the United States dollar exchange rate, January 1997–February 2012

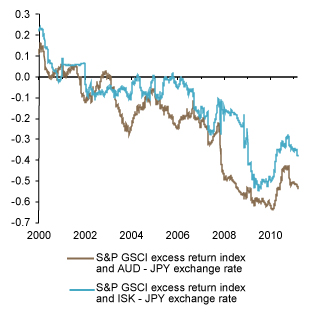

(Coefficient)  Source: UNCTAD, TDR 2011 (Chart 5.9.A) March 2012 update Note: The data reflect one-year rolling correlations of returns on the respective indices, based on daily data. (Chart) Correlation between financial investment in commodities and the Japanese yen exchange rate,December 2000–February 2012

Source: UNCTAD, TDR 2011 (Chart 5.9.A) March 2012 update Note: The data reflect one-year rolling correlations of returns on the respective indices, based on daily data. (Chart) Correlation between financial investment in commodities and the Japanese yen exchange rate,December 2000–February 2012

(Coefficient)  Source: UNCTAD secretariat calculations, based on Bloomberg Note: The data reflect one-year rolling correlations of returns on the respective indices, based on daily data. . Moreover, recent studies suggest that many financial investors have come to follow more active strategies in commodity markets, compared with the relatively passive investment behaviour of index investors on which much of the debate had focused earlier. Such more active strategies appear to be subject to so-called information-based herding which refers to traders’ beliefs that they can glean relevant information by observing the behaviour of others. In such a situation, position-taking behaviour across market participants converges and price signals emanating from commodity futures exchanges become increasingly less reflective of changes in market fundamentals. As a result, snowballing effects may develop that eventually causes asset price bubbles.

Source: UNCTAD secretariat calculations, based on Bloomberg Note: The data reflect one-year rolling correlations of returns on the respective indices, based on daily data. . Moreover, recent studies suggest that many financial investors have come to follow more active strategies in commodity markets, compared with the relatively passive investment behaviour of index investors on which much of the debate had focused earlier. Such more active strategies appear to be subject to so-called information-based herding which refers to traders’ beliefs that they can glean relevant information by observing the behaviour of others. In such a situation, position-taking behaviour across market participants converges and price signals emanating from commodity futures exchanges become increasingly less reflective of changes in market fundamentals. As a result, snowballing effects may develop that eventually causes asset price bubbles.

These developments have important implications for the traditional roles of commodity futures exchanges in price discovery and risk management, as well as for the associated benefits for commercial market users. Rather than aggregating, discovering and spreading valuable private information from a multitude of independent market participants, commodity futures exchanges will come to follow more closely the logic of asset markets in which price discovery is based on information related to only a few commonly observable events, or even refer to mathematical models that mainly use past information for position-taking decisions. The risk of speculative bubbles and prolonged deviations from fundamental values rises accordingly, with a potential for distorting economic activities and causing financial fragilities. Moreover, commercial users will fail to benefit from lower transactions costs that would normally be associated with increased market liquidity, and they may well end up shouldering higher hedging costs owing to the greater uncertainty caused by financial investors.

The financialization of commodity markets is but one prominent and more recent aspect of broader financialization trends witnessed in the era of financial liberalization across much of the globe, especially in advanced economies. While financial investors seeking to diversify their portfolios may have viewed commodities as an attractive alternative asset class, the return on which was presumed to be negatively correlated with that on equities and bonds over the business cycle, such strategies have proved ultimately self-defeating as the greater participation of financial investors has caused commodity markets to follow more the logic of financial markets and move in parallel with financial conditions in general. As a result, financial investors in commodity markets may have come to emphasize the search for higher yields, rather than merely attempting to diversify risk. Important economic risks may arise from these developments, and quite unnecessarily so. There is scope for improving transparency in physical and futures commodity markets and for regulatory measures designed to contain the destabilizing influence of financial investors and risk of bubbles.

Highlights

- Recent developments in primary commodity prices have been exceptional in many ways;

- Sizeable commodity price volatility can adversely affect both commodity importing and exporting countries, as well as affect the resilience of households and commodity producers;

- Commodity price swings coincided with major shifts in market fundamentals but also with a rising presence of financial investors in commodity derivatives markets;

- The financialization of commodity markets has accelerated significantly since about 2002–2004;

- The financialization of commodity markets may cause price signals emanating from commodity futures exchanges to become increasingly less reflective of changes in market fundamentals;

- Further damaging real effects arise from increased hedging costs for commercial traders related to greater price volatility;

- Rising bubble risks raise broader systemic issues;

- Greater market transparency and tighter regulatory measures are called for to contain the price impact of financial investors and the associated risk of bubbles.

To learn more

UNCTAD Trade and Development Report 2011, Chapter V Financialized Commodity Markets: Recent Developments and Policy issues, UNCTAD/TDR/2011

UNCTAD Trade and Development Report 2009, Chapter II The Financialization of Commodity Markets, UNCTAD/TDR/2009

UNCTAD Trade and Development Report 2008, Chapter II Commodity Price Hikes and Instability, UNCTAD/TDR/2008

Price Formation in Financialized Commodity Markets: The Role of Information, Study prepared by the secretariat of UNCTAD, UNCTAD/GDS/2011/1