Special challenges facing emerging market economies and least developed countries owing to the volatility in commodity prices

Special challenges facing emerging market economies and least developed countries owing to the volatility in commodity prices

The fluctuations of commodity prices remain a central issue for developing countries. Often the collapse of commodity prices spells disaster for developing countries, since exports are needed for obtaining essential imports. But also, high commodity prices, particularly of food and energy, may be a significant problem for least developed countries Least developed countries (LDCs) are identified on the basis of low income, human assets and economic vulnerability.

more(LDCs) creating food and energy shortages.

Commodity price developments have traditionally been discussed in terms of changes in fundamental supply and demand relationships. However, there is increasing support for the view that recent commodity price movements have also been influenced by the growing participation of financial investors in commodity trading. Uncertainty and instability were the major distinguishing features of commodity markets in 2010 and 2011.

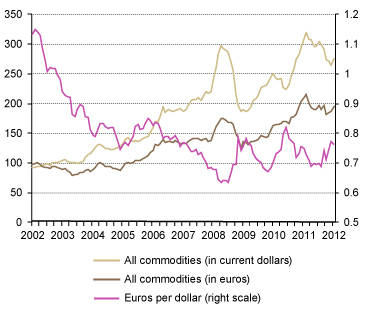

Monthly evolution of non-fuel commodity price indices and exchange rates, January 2002-January 2012

(Index numbers, 2000=100 and exchange rate)

Source: UNCTAD, TDR 2011 (Chart 1.4), based on UNCTADstat Commodity Price Statistics and IMF, IFS

This is reflected in greater volatility of commodity prices than in the past, similar to the period of the commodity boom prior to the eruption of the global financial and economic crisis in 2008. The prices of commodities and some subcategories (food, metals, and energy) grew significantly starting in the late 1990s, and it is also clear that since 2006, volatility has increased considerably.

After declining in the second quarter of 2010, commodity prices generally surged until early 2011, and then reversed the trend. Price increases were associated with three broad tendencies: (a) rising demand that reflected the recovery in the world economy, and, in particular, robust growth in developing countries; (b) supply shocks; and (c) the increased financialization of commodity markets.

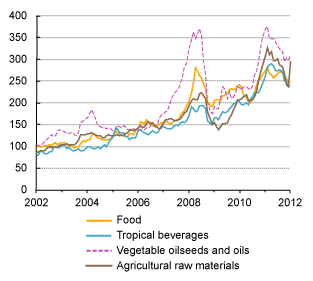

The price indices for all commodity groups peaked in February 2011 at levels close to those reached in 2008, except for tropical beverages and agricultural raw materials, which were considerably higher (Chart) Monthly evolution of agricultural commodity price indices, January 2002-January 2012

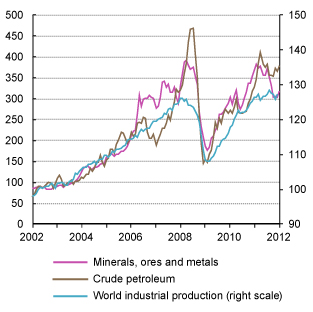

(Index numbers, 2000=100)  Source: UNCTAD, UNCTADstat Commodity Price Statistics . Although commodity prices generally declined over the second half of 2011, they have remained at relatively high levels. This reversal of the upward trend, particularly in the case of energy commodities and minerals and metals, seems partly due to the slowdown in world industrial production growth (Chart) Monthly evolution of oil, mineral and metal price

Source: UNCTAD, UNCTADstat Commodity Price Statistics . Although commodity prices generally declined over the second half of 2011, they have remained at relatively high levels. This reversal of the upward trend, particularly in the case of energy commodities and minerals and metals, seems partly due to the slowdown in world industrial production growth (Chart) Monthly evolution of oil, mineral and metal price

indices and world industrial production,

January 2002-January 2012

(Index numbers, 2000=100)  Source: UNCTAD, TDR 2011(Chart 1.4), based on UNCTADstat Commodity Price Statistics and CPB Netherlands Bureau of Economic Policy Analysis, World Trade database Note: Price indices are in current values and world industrial production is in constant values. . Curbing financial speculation in commodity markets is central to guarantee economic prosperity in developing countries.

Source: UNCTAD, TDR 2011(Chart 1.4), based on UNCTADstat Commodity Price Statistics and CPB Netherlands Bureau of Economic Policy Analysis, World Trade database Note: Price indices are in current values and world industrial production is in constant values. . Curbing financial speculation in commodity markets is central to guarantee economic prosperity in developing countries.

| Commodity price instability indices, 2001-2010 | ||||

|---|---|---|---|---|

| 2001-2010 | Volatility | |||

| Non-fuel commodities | 9.8 | Medium | ||

| All food | 7.5 | Medium | ||

| Food | 8.2 | Medium | ||

| Tropical beverages | 6.4 | Medium | ||

| Vegetable oilseeds and oils | 15.3 | High | ||

| Agricultural raw materials | 7.6 | Medium | ||

| Minerals, ores and metals | 20.8 | High | ||

| Crude petroleum | 20.1 | High | ||

| Source: UNCTAD secretariat calculations, based on UNCTADstat | ||||

Commodity exporters can take advantage of these relatively high prices for financing development. Government intervention through taxation or direct involvement in primary activities is essential for capturing a significant share of the generated rent. Instability Instability is measured as the percentage deviation of the prices from their exponential trend levels for the period.

can be addressed through stabilization funds and countercyclical macroeconomic policies in order to avoid currency overvaluation and the generation of boom-and-burst episodes. In poor commodity-importing countries, domestic financing and foreign aid should be devoted to the development of food production and new energy sources, and to the provision of contingent finance in case of price hikes.

Highlights

- Commodity exports have a positive effect on economic growth in many developing and emerging markets;

- High commodity prices, particularly of food and energy, may be a significant problem for less developed countries, creating food and energy shortages;

- Recent commodity price movements have been influenced by the growing participation of financial investors in commodity trading;

- Curbing financial speculation in commodity markets is central to guarantee economic prosperity in developing countries.

To learn more

The Least Developed Countries Report 2010, Chapter VI An Agenda for Action: Commodities, UNCTAD/LDC/2010

Special issue on Cotton in Africa, Commodities at a Glance, UNCTAD N°2 - July 2011

Historical Evolution of Primary Commodity Prices and Indices, Commodities at a Glance, UNCTAD N°1 - March 2011

Global Crises and the Commodity Dependence of the Least Developed Countries: Impacts, Challenges and the Way Forward, UNCTAD/ALDC/MISC/2011/6

Development Impacts of Commodity Exchanges in Emerging Markets, Report of the UNCTAD Study Group on Emerging Commodity Exchanges, UNCTAD/DITC/COM/2008/9

Sustainable Agriculture and Food Security in LDCs, UNCTAD Policy Briefs, No. 20(c), 09/05/2011

LDCs’ boom and bust in the 2000s: the turbulent decade, UNCTAD Policy Briefs, No. 20(d), 09/05/2011