Global capital flow trends

Global capital flow trends

After having surged to unprecedented levels in 2007 and until mid-2008, private capital flows Private capital flows cover direct investment, portfolio investment and other investment.

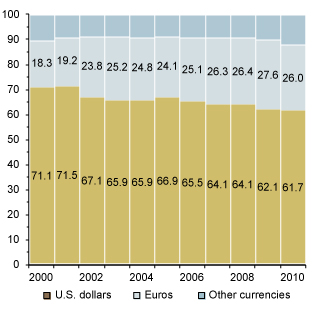

towards developing countries came to a sudden stop or even reversed direction as the system went into cardiac arrest, fleeing back towards the core countries of global finance that were the epicenter of the crisis. Most currencies experienced huge exchange rate gyrations vis-à-vis the United States dollar, functioning as the world's key reserve currency (Chart) Currency composition of reserves, 2000-2010

(Percentage of currency)  Source: UNCTAD secretariat calculations, based on IMF, COFER database and IFS .

Source: UNCTAD secretariat calculations, based on IMF, COFER database and IFS .

Tentative recovery began in the spring of 2009 under continued massive policy support from key central banks in developed countries. But volatility stayed at elevated levels and fresh stresses emerged starting in the winter of 2010, now concentrated in the European countries that share the euro as their currency. Developing countries experienced another surge in capital inflows after mid-2009 followed by yet another reversal in the course of 2011 as the European debt crisis worsened. Renewed disruptive exchange rate swings vis-à-vis the United States dollar broadly mirrored the tidal flows of private capital. Global finance remains in upheaval.

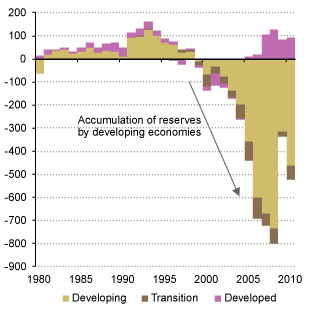

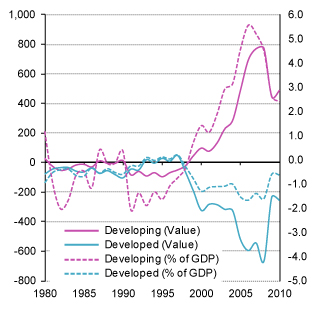

Financial globalization has proceeded at an even more rapid pace than trade globalization over the past few decades. While the developed economies continue to be the most financially integrated, more and more developing countries have meanwhile liberalized and at least partially opened up their financial systems. Since the early 1990s, private capital flows reached the shores of developing countries in two strong waves. The emerging market crises of the late 1990s and the global crisis of 2008–2009 provided the major breaking points that saw sharp reversals (Chart) Total net capital flows and change in reserves by region, 1980-2010

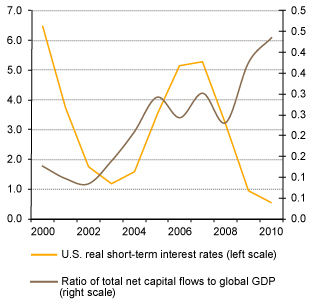

($ billions)  Source: UNCTAD secretariat calculations, based on IMF, WEO October 2011 . Apart from crises, the monetary policy and business cycle in leading developed countries provide the other key driving force for global capital flows involving the developing world (Chart) Cycles in United States real short-term interest rates and total net capital flows towards developing economies, 2000-2010

Source: UNCTAD secretariat calculations, based on IMF, WEO October 2011 . Apart from crises, the monetary policy and business cycle in leading developed countries provide the other key driving force for global capital flows involving the developing world (Chart) Cycles in United States real short-term interest rates and total net capital flows towards developing economies, 2000-2010

(Percentage and percentage of world GDP)  Source: UNCTAD secretariat calculations, based on UNCTADstat; IMF, WEO October 2011; and OECD, Economic Outlook database .

Source: UNCTAD secretariat calculations, based on UNCTADstat; IMF, WEO October 2011; and OECD, Economic Outlook database .

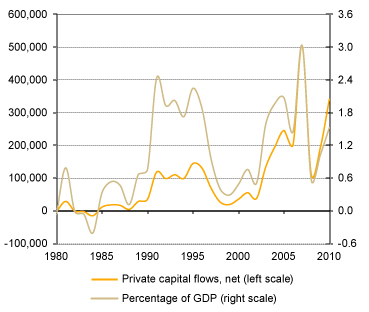

While more and more developing countries have become prominent destinations of private capital inflows, especially since the 2000s, many have also experienced rising private capital outflows.

Net private capital flows towards developing and transition economies, 1980-2010

($ millions and as percentage of recipient countries' GDP)

Source: UNCTAD secretariat calculations, based on IMF, WEO October 2011

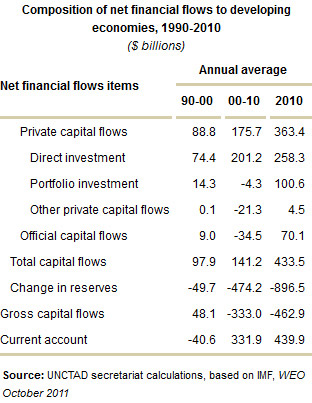

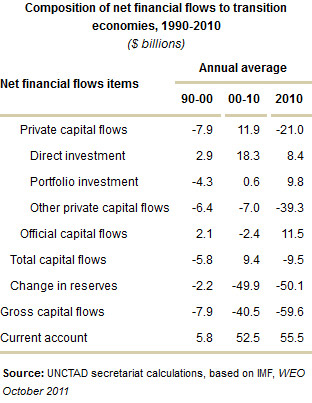

Private capital flows consist of three main categories: foreign direct investment Foreign direct investment (FDI) is investment involving a long-term relationship and lasting interest in and control by a resident entity in one economy in an enterprise resident in another economy. In FDI, the investor exerts significant influence on the management of the enterprise resident in the other economy.

more(FDI), portfolio investmentPortfolio investment flows cover equity and debt securities, such as bonds, notes, money market instruments and financial derivatives (options etc.).

, and other investmentOther investment flows is a residual category that includes all financial transactions not covered under direct investment, portfolio investment or reserve assets.

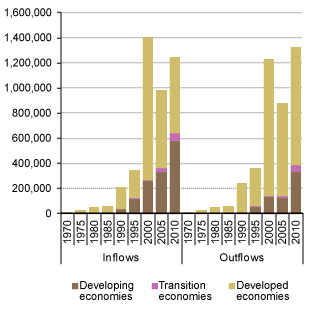

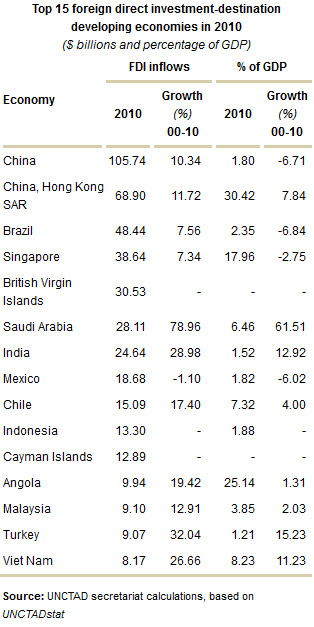

; the latter including international banking flows. A compositional breakdown reveals a rise in the role of FDI (Chart) Inflows and outflows of foreign direct investment, 1970-2010

($ millions)  Source: UNCTAD secretariat calculations, based on UNCTADstat (Table)

Source: UNCTAD secretariat calculations, based on UNCTADstat (Table)  (Table)

(Table)  and portfolio flows and relative decline in international bank lending flows (Table)

and portfolio flows and relative decline in international bank lending flows (Table)  (Table)

(Table)  .

.

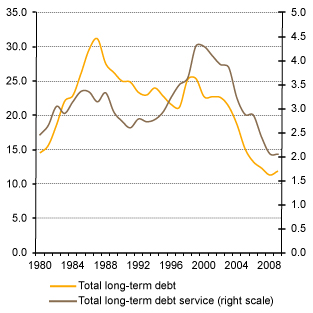

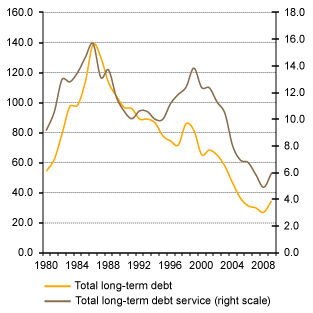

The rise in international capital flows involving developing countries has led to a corresponding rise in cross-border financial holdings and an expansion in their international investment positions, recording foreign assets and liabilities. The relative rise in developing countries gross foreign assets and liabilities provides further evidence of progressing financial globalization. Increasingly developing countries too are becoming part of globally interconnected balance sheets. In many developing countries, the concomitant rise in foreign assets and liabilities has seen an improvement in their net foreign asset positions, a process mainly driven by improved current account positions (Chart) Current account, net, of developed and developing economies, 1980-2010

($ billions (left scale) and as percentage of GDP (right scale))  Source: UNCTAD secretariat calculations, based on UNCTADstat . Running a current account surplus position allows a country to either reduce its foreign debt and/or accumulate foreign assets, including international reserves. External debt trends over the last decade brought a continued general improvement of developing countries’ debt indicators. External debt expressed as a percentage of gross national income Gross national income (GNI) is gross domestic product (GDP) less net taxes on production and imports, less compensation of employees and property income payable to the rest of the world plus the corresponding items receivable from the rest of the world.

Source: UNCTAD secretariat calculations, based on UNCTADstat . Running a current account surplus position allows a country to either reduce its foreign debt and/or accumulate foreign assets, including international reserves. External debt trends over the last decade brought a continued general improvement of developing countries’ debt indicators. External debt expressed as a percentage of gross national income Gross national income (GNI) is gross domestic product (GDP) less net taxes on production and imports, less compensation of employees and property income payable to the rest of the world plus the corresponding items receivable from the rest of the world.

more(GNI) (Chart) Total long-term debt and debt service of developing economies as percentage of gross national income, 1980-2009

(Percentage of GNI)  Source: UNCTAD secretariat calculations, based on UNCTADstatand as a percentage of exports of goods and services (Chart) Total long-term debt and debt service of developing economies as percentage of exports of goods and services, 1980-2009

Source: UNCTAD secretariat calculations, based on UNCTADstatand as a percentage of exports of goods and services (Chart) Total long-term debt and debt service of developing economies as percentage of exports of goods and services, 1980-2009

(Percentage of exports of goods and services)  Source: UNCTAD secretariat calculations, based on UNCTADstat both declined. Helped by declining global interest rates, the debt-servicing burden of developing countries as a group also decreased substantially.

Source: UNCTAD secretariat calculations, based on UNCTADstat both declined. Helped by declining global interest rates, the debt-servicing burden of developing countries as a group also decreased substantially.

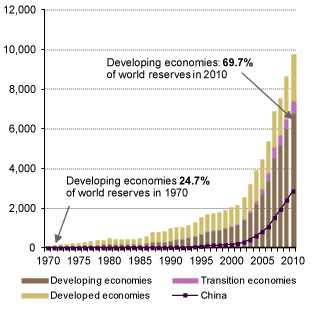

Apart from paying off external debt or reduced overall reliance on foreign debt, many developing countries used improved current account positions to build up their holdings of international reserves. Rising reserves were also sourced from net private capital inflows. While concentrated in China, the unprecedented rise in international reserves has been a widespread phenomenon in the developing world, commonly referred to as self-insurance.

International reserve holdings serve precautionary purposes, and common indicators thus suggest that developing countries markedly increased their precaution in the era of progressing financial globalization, especially in response to the crises of the late 1990s (Chart) Reserves of developing, developed and transition economies and China, 1970-2010

($ billions)  Source: UNCTAD secretariat calculations, based on UNCTADstat Note: End of year position . Recourse to reserve accumulation as self-insurance is part of a broader preference for defensive macroeconomic policies, including avoidance of an overvalued currency. As financial globalization proved hazardous in the experience of many developing countries, maintenance of a competitive exchange rate became a policy focus. If foreign exchange market interventions are used to contain pressures for currency appreciation, a build-up of international reserves arises as a by-product.

Source: UNCTAD secretariat calculations, based on UNCTADstat Note: End of year position . Recourse to reserve accumulation as self-insurance is part of a broader preference for defensive macroeconomic policies, including avoidance of an overvalued currency. As financial globalization proved hazardous in the experience of many developing countries, maintenance of a competitive exchange rate became a policy focus. If foreign exchange market interventions are used to contain pressures for currency appreciation, a build-up of international reserves arises as a by-product.

The hazards of unfettered global finance were once again illustrated with spectacular vehemence and reach in the global crisis. Even developing countries that had seemed to be in excellent shape and had shored up their defences through large international reserve holdings were caught in the global contagion; albeit generally less so than countries that were running large current account deficit positions prior to the crisis, concentrated in Eastern Europe.

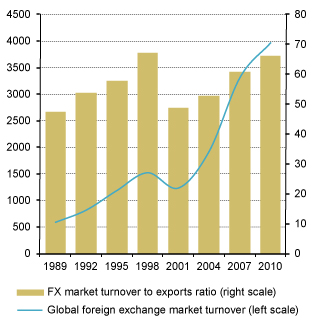

Ratio of foreign exchange market turnover divided by value of merchandise exports, 1989-2010

(Average daily turnover in April, $ billions (left scale) and ratio (right scale))

Source: UNCTAD secretariat calculations, based on IMF, DOTS and BIS, Triennial Central Bank Survey

Note: Merchandise exports in April are first converted into daily figures for the ratio calculation.

Perhaps the rule of finance over trade in the modern age of accelerated globalization is best illustrated by trading in foreign exchange markets. Daily foreign exchange trading has reached over 4 trillion, including spot and forward markets and other foreign exchange derivates that feature prominently in carry trades. While still in the teens in the late 1970s, the ratio of yearly foreign exchange market turnover over merchandise exports had reached about 50 in the 1980s, and has doubled again since. The current ratio of around 100 implies that only about 1 percent of foreign exchange trading is actually related to merchandise trade.

The conspicuous rise of derivatives provides another indicator and symptom of the fragility of unfettered global finance, including credit derivatives such as credit default swaps and collateralized debt obligations. Hailed as welcome innovations in an era cherishing beliefs in self-regulation, these products came to prove lethally destructive far beyond their centres of origin in the developed world.

Highlights

- Global capital flows have grown much faster than GDP gross domestic product and trade;

- Capital flows towards developing countries are highly cyclical;

- Despite the relative rise in role of FDI, capital flows are fickle;

- Financial integration and openness of developing countries are on the rise, both in terms of capital flows and cross-border holdings;

- Despite widely improved external positions, developing countries proved vulnerable in the global crisis because of greater integration and interconnectedness in unfettered global finance.

To learn more

UNCTAD Trade and Development Report 2008, Chapter III International capital flows, current-account balances and development finance, UNCTAD/TDR/2008

Contribution by the UNCTAD Secretariat to G20 Working Group on the Reform of the International Monetary System (Subgroup I: Capital Flow Management), May 2011

Contribution by the UNCTAD Secretariat to G20 Working Group on the Reform of the International Monetary System (Subgroup I: Capital Flow Management), March 2011